income tax efiling malaysia

Just upload your form 16 claim your deductions and get your acknowledgment number online. 1961 is available to the individuals who have a yearly income up to Rs.

Ecovis Malaysia Reminder Income Tax Filing Deadline

Gratuity is a good option to create a decent corpus.

. Under Section 80EE of Income Tax Act one can claim deduction up to Rs. The advance tax payment needs to occur in accordance with a fixed schedule which has been stipulated by the income tax department which is. Paying advance taxes on income projections may require complicated adjustments and revisions.

Tax Saving is the best options for investment like Section 80C offers Rs. Efiling Income Tax ReturnsITR is made easy with Clear platform. Clear serves 15 Million happy customers 20000 CAs tax experts 10000 businesses across India.

The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. 100 of the advance tax to be paid. Spun out of Harvard Law School our team includes lawyers engineers and judges.

It is mentioned in Section 80C of the Income Tax Act 1961 that the interest earned during the PPF tenure is exempted from ones tax liability. The annuity plan you have invested in should be for receiving the pension from a fund being referred to in Section 1023AAB. The form 16 comprises of two parts Part A and Part B.

The capital assets definition is given us 214 of the IT Act 1961. Income tax payable if your income exceeds 25 lacs annually. We have world-class funders that include the US.

According to the budget released in 2019 there have been some changes in the structure of the tax slab in the interim budget 2019 the tax rebate of Rs. 25000 on the premium paid towards health insurance under section 80D of the Income Tax Act. It is mandatory to file ITR for individuals If the gross total income is over Rs250000 in a financial year.

As per the Article 10 10 I of the Online Income Tax the gratuity payment received by a government employee except for the statutory corporation is completely exempt of tax. A person can claim a deduction of up to Rs. 1 crore then high tax liabilities accrues each quarter.

If you are not registered you can find your tax number on your tax return. HRA or House Rent allowance also provides for tax exemptions. Part A serves as the proof of Tax Deducted at Source TDS deduction by the employer.

Section 10 14 provides tax benefit up to Rs 1200 per year per child up to two children for expenses on education including. For example if a self earning entity generates a yearly income of Rs. It is best to make advance tax payment on actual income already released and net income projections.

Under the Section 11A on the Income Tax Act equity and equity shares funds that have been sold in stock exchange and securities transaction tax on such short-term capital gains is chargeable to tax at a rate of 10 percent up to 2008-9 and 15 percent from 2009-10 onwards. Upsolve is a 501c3 nonprofit that started in 2016Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free using an online web app. Income Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund deductions exemptions calculations types of taxes FY 2022-23.

You can use your debit or credit card to make payments in your NPS account. Further you can also file TDS returns. Whereas part B is just an annexure that lists your salary due tax tax paid and other income if any.

Tax Offences And Penalties In Malaysia. Read the article and clear all your doubt of gratuity if you are just near to completing 5 years in an organization. As per Income Tax Acts Article 10 10 ii the death or and retirement gratuity receivable by an individual who is covered under the Gratuity Act 1972 is considered.

50000 on home loan interest. In addition to this if the house is vacant. Income tax deductions on tuition fees expenses of school and college going children in India can be claimed by individual employed in India under section 10 14 of the income tax act.

Efiling Income Tax ReturnsITR is. Just upload your form 16 claim your deductions and get your acknowledgment number online. Tax benefit by investing in NPS can be benefitted under Section 80C of the Income Tax Act.

Salaries of the employees of both private and public sector organizations are composed of a number of. Government former Google CEO Eric Schmidt and leading. Further you can also file TDS returns.

Under this section of income tax individuals can avail of income tax exemptions on up to Rs 150000 if he or she has invested or deposited in any annuity plan with LIC or another insurer. A maximum of Rs. How Does Monthly Tax Deduction Work In Malaysia.

150000 can be claimed as deductions if you invest in NPS along with the host of other tax-saving instruments like PPF ELSS Life Insurance etc. The gain that arises from the transfer of long term capital assets is considered as long term capital gain and in the same way the gain that arises. Income Tax Slab Rates for FY 2019-20 AY 2020-21.

The PPF deposit up to 15 lakh is liable to the exemption and the amount to be received on maturity is also tax-free. Section 54F of Income Tax. The house owners are allowed to claim an income tax deduction of up to Rs2 Lakhs Rs1 50 000 if one is filing the income tax returns for Financial Year 2013-14 on the interest of the home loan if the owner and hisher family is living in that house only.

75 of the advance tax to be paid before 15 th December. Also learn income tax slab rates in FY 2016-17. This limit exceeds Rs300000 for senior citizens and Rs500000 for super senior citizens.

The capital assets as per ownerships period are divided into two categories - Short Term Capital Assets and Long Term Capital Assets. 45 of the advance tax to be paid before 15 th September. Efiling Income Tax ReturnsITR is made easy with Clear platform.

The form also contains a monthly statement of the same. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Know all about Income Tax in India types of direct indirect taxes.

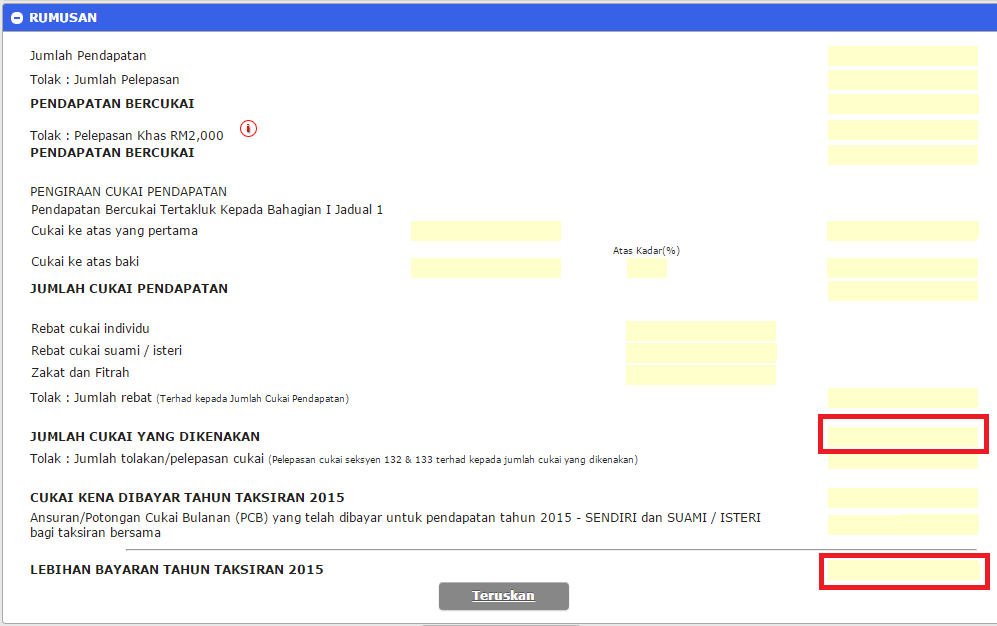

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. 15 of the advance tax to be paid before 15 th June. Guide To Using LHDN e-Filing To File Your Income Tax.

Deduction on Interest of Home Loan. Which Sections Address Income Tax Deduction Benefit for Tuition Fees. 15 lakhs tax saving mutual funds ELSS PPF NPS 80CCD 80D.

How To Pay Your Income Tax In Malaysia. Who Should Pay Income Tax. A 10-digit number assigned by SARS to each taxpayer upon registration as a taxpayer is known as an income tax reference number.

Tax Saving - How to Save Income Tax For FY 2022-23. In the event that you are registered you may find your tax number on your Income Tax Workpage on eFiling provided you are an authorized eFiler. Form Part A.

12500 under Section 87A of IT Act. Clear offers taxation financial solutions to individuals businesses organizations chartered accountants in India. Understanding Income Tax Form 16.

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

E Filing Beginners Guide Q A Part 1 Income Tax Malaysia 2022 Youtube

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Assessing E Government Services The Case Of E Filing Of Personal Income Tax In Malaysia Government Law Book Chapter Igi Global

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

How To File Income Tax In Malaysia Using E Filing Mr Stingy

Income Tax E Filing Starts On March 1

Guide To Using Lhdn E Filing To File Your Income Tax

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

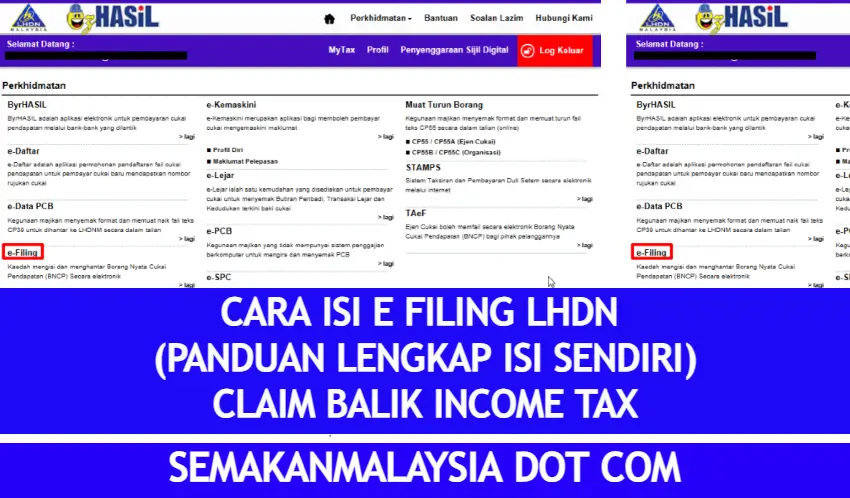

Cara Isi E Filing 2022 Panduan Lengkap Claim Income Tax Borang Be Semakan Malaysia

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Dateline To Submit Tax Return Forms And Payment For Balance Of Tax For

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

The Irs Made Me File A Paper Return Then Lost It

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Comments

Post a Comment